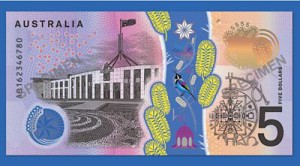

Getting a packet of chips from the office vending machine could soon become a more interesting experience after the RBA (Reserve Bank of Australia) revealed that the nation’s new five dollar note will feature a prominent transparent strip and a far more colourful design.

Due to be released on 1st September this year, the long term project to upgrade Australia’s five dollar note by the government’s central bank has potentially profound implications for businesses that operate automatic banknote readers that range from junk food vending machines to pokies and even pay parking facilities.

“Innovative new security features have been incorporated to help keep Australia’s banknotes secure from counterfeiting into the future,” said RBA Governor Glenn Stevens.

“As can be seen in the images, these include a distinctive top-to-bottom window. Each banknote in the new series will depict a different species of Australian wattle and a native bird within a number of the elements. On the $5 banknote, these are the Prickly Moses wattle and the Eastern Spinebill.”

Flora and fauna aside, the release of the new five dollar banknote is a big deal and not just for numismatics enthusiasts.

As cards and electronics payments progressively eat away at the role of cash among higher denominations – especially above the psychological $10 card payment threshold still foisted on customers by many merchants – the role of the five dollar bill increases in both turnover and significance in cash transactions.

If you’ve ever noticed that five dollar notes seem to be the most worn and beaten up of banknotes in your wallet, that’s because the change hands across the counters of coffee shops, newsagents and pubs far more frequently than other denominations.

But while the new notes undoubtedly be a physical improvement of the old purple favourites in terms of tactile feel and durability, their issuance will require major upgrades from businesses ranging from banks to confectioners.

Supermarkets that use self-service checkouts are also in the frame.

“The number of machines in Australia that process banknotes in one form or another is substantial – it is estimated that there are more than 30,000 ATMs, 8,000 self-service checkouts, 200,000 gaming machines and more than 250,000 vending machines in Australia that will need to be upgraded and reconfigured to ensure that they can accept and dispense the new banknotes,” the RBA said on its Banknote Stakeholder Engagement page.

So far the RBA seems confident industry is across the change and will be ready for the adjustment.

So far the RBA seems confident industry is across the change and will be ready for the adjustment.

“As of September 2015, the Bank [RBA] has engaged with all companies that it is aware of as active in the Australian market. It is expected that these companies make up the majority of the industry. The outcomes from this engagement have been positive and the Bank is becoming increasingly confident that most machines will be able to process the new banknotes when the first denomination is issued,” the RBA said.

However the cash reader upgrades are likely to trigger a different kind of response from payments operators who are just as likely to use the need to upgrade as a catalyst to fit contactless card readers.

Either way, the path to the 3pm junk food transaction is about to get more interesting one way or another.

I think it looks stupid to be honest and fair but then again given the RBA’s track record the last few years that’s fitting it looks stupid …

Its only money…

I don’t have money in my hands long enough to even look at the notes, so it won’t bother me at all!!!!!!!!!!!

why is the Queen still on it???

Why would we have a foreign leader on our money? There is not even a facade of independence in this country. Utterly disgraceful and showing no allegiance to our own country, regardless of historical ties.

Would you rather Abbott?

Must we still have the tired old queen gracing our currency. What about Rolf Harris??

Please review the colours of the Eastern Spinebill, there is no blue or purple in this species. If the RBA is after some blue and purple maybe the Blue-breasted Fairy-wren would be a better fit.

I don’t mind upgrading notes, new looks etc however who in the right mind would not take into consideration the costs to upgrade note reading equipment. Why wouldn’t this be taken into consideration during development. What a waste of money. Whoever makes these decisions do not use their common sense.

The number of machines in Australia that process banknotes in one form or another is substantial – it is estimated that there are more than 30,000 ATMs, 8,000 self-service checkouts, 200,000 gaming machines and more than 250,000 vending machines in Australia that will need to be upgraded and reconfigured to ensure that they can accept and dispense the new banknotes,” the RBA said on its Banknote Stakeholder Engagement page.

RBA cash graph graph-0915-1-01

Is that Pink Building at the bottom of the strip supposed to be parliament House? I dont recall it ever being pink!!LOL

Or could it be a mosque? Hmmm…

it’s the federation pavilion in centennial park sydney.

It is so not it has a steeple and looks like the top half of the washington state capital building, Austalians should be in uproar. It does not resemble the australian federation pavillion at all.

Just another cost impost on small clubs

Who is going to compensate small business for the changes? There is going to be 3 new notes in the next three years. I have to have my seven different note readers removed, sent away for calibration, re-installed 3 weeks later at a huge cost and loss, then have to do it again next year and again the year after. WTF! Who in their right mind thought of this idiocy? Is there going to be some form of compensation? The RBA should be able to compensate small business for this with the savings in the lack of counterfeiting.

I would have preferred the De Plane De Plane guy, from Fantasy Island on the note!