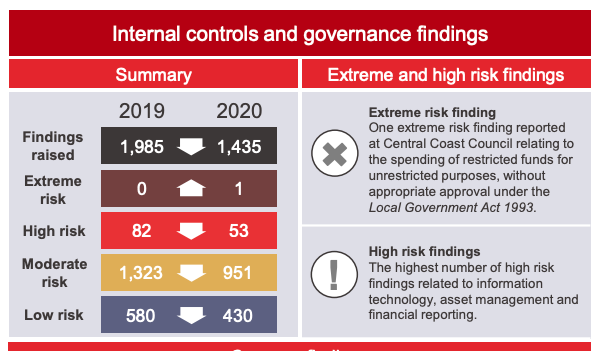

An audit of the NSW local government sector has made 53 high risk findings and one extreme risk finding.

The NSW auditor general Margaret Crawford released the results of financial audits of the local government sector for the year ending June 2020 on Thursday.

The report shows that twenty-one high risk matters related to asset management, 14 related to IT and seven related to financial reporting.

The remainder were around governance, accounting, purchasing and payables, and cash and banking.

The extreme risk finding related to the use of restricted funds for general purposes without appropriate approval by Central Coast council, which is currently in the hands of an administrator after financial mismanagement left if $89 million in the red.

Cyber security lacking

The report found 110 councils had missing or outdated policies and procedures and fixed asset registers were incomplete or inaccurate at 64.

Fifty-eight lacked proper cyber security controls and 63 were rated ‘could do better’ on asset valuation and management.

Thirty five had issues around procurement including insufficient segregation of duties.

The report found deficiencies in fraud control at 41 councils, including 30 that didn’t have a fraud and corruption prevention policy or had an outdated one.

Other common deficiencies were failure to perform fraud risk assessments, not requiring staff to attest to the Code of Conduct and not providing fraud awareness training.

Ms Crawford also noted that 22 per cent of councils had engaged in emergency procurement , which heightened the risk of fraud.

“In times of emergencies, there may be a need to engage in emergency procurement, using direct negotiations and other exemptions from the competitive procurement process to pay suppliers quickly, agree to contract variations and rely on staff to purchase items using purchasing cards,” she said.

“There is a risk that emergency procurement may not be processed appropriately.”

She also found governance and internal controls around local infrastructure contributions could be improved.

Errors increase

The total number of corrected and uncorrected errors increased compared to the previous year.

The audit identified 238 corrected errors in financial statements, worth more than $1 billion, in 2020. That compared to 185 errors worth $547 million identified the previous year.

Sixty-eight councils also failed to include $119 million worth of rural fire fighting equipment in their financial statements, which accounted for 27 per cent of uncorrected errors.

NSW councils by the numbers for 2019-20

- Rates and annual charges collected: $7.3 billion

- Grants and contributions received: $4.7 billion

- Employee benefits and on-costs incurred: $4.8 billion

- Cash and investments held: $14.2 billion

- Infastructure, property, plant and equipment managed: $160 billion

- Borrowings entered into: $3.3 billion

- Stimulus funding committed to councils to manage impact of covid: $500 million

Adapting to emergencies

The report also explores how councils were affected by emergency events, including covid-19, during the audit period.

A major challenge was adapting IT infrastructure and controls to working from home, and many also supported their communities with emergency funding and grants.

Despite this, 56 per cent of metropolitan councils were able to report an operating result that was favourable compared to budgets set in May 2019.

The report says this was because a decrease in charges and fees was offset by an increase in grants and contributions, and a decrease in employee costs.

The story was different for regional councils however, with 54 per cent having an operating cost that fell short of their original budget.

Ms Crawford said bushfires, floods and the pandemic have created additional risks and challenges for local government, and changed the way councils deliver their services.

“Local councils and their communities will continue to experience the effects of recent emergency events, including the bushfires, floods and the COVID-19 pandemic for some time,” she said.

Future audits would look at emergency preparedness and responses, risks arising from quick decision making and whether government investment has achieved desired out comes, she said.

87 page audit report an insight to NSWG failed with its Local Government reforms with Forced mergers.

AGNSW Report reveals: Numerous IT and Finance systems. rather than One fully supported OLG platform.

And really highlights the amazing work of LG Staff who suffered through Drought, Fire and Covid.

Hope these findings are a turning point to better financial management at the local level.

Two things stick out. “Employee entitlements” now climb to 65.7% of total rates income, and Councils increasingly rely on value of “infrastructure” to balance their budget. If balancing the budget gets a little wobbly, all you do is throw a few more logs on the “asset” side of the ledger, and manually adjust the formula for working out asset value, by a degree or so, and Bob’s your uncle.

If the “assets” were KFC or Macka outlets, yes you could accept they were of real value.

But, most of the assets are “toxic”with “Nil” resale value on the open market, and leak

reoccurring maintenance cost, bit like keeping dry river sand in rice strainer.

Local Councils need to reduce the size of their footprint, and allow private enterprise to

take up the slack. In the final analysis, it is only the actual number of “rate payers” on the books who must come up with the money for the next round of wage increases.

The bulk of the nations “royalties” and taxes are being collected by State and Federal Governments .

It is therefore logical that cost incurred in fronting up to fight natural disasters, should be shared by these two debt collectors, and not become a double whammy for the people

living in the affected areas.