Central Coast Council is headed for a $115 million operating loss this financial year thanks to “catastrophic” mismanagement, a report by the administrator has found.

The report also found that restricted reserves of more than $200 million were unlawfully used.

Council now faces a $40 million asset sell-off, the loss of hundreds of jobs and a purge of middle and senior management.

Local government minister Shelley Hancock suspended counsellors on October 30 and appointed Dick Persson as administrator to restore function at the stricken council, which last year found itself $32.5 million in the red.

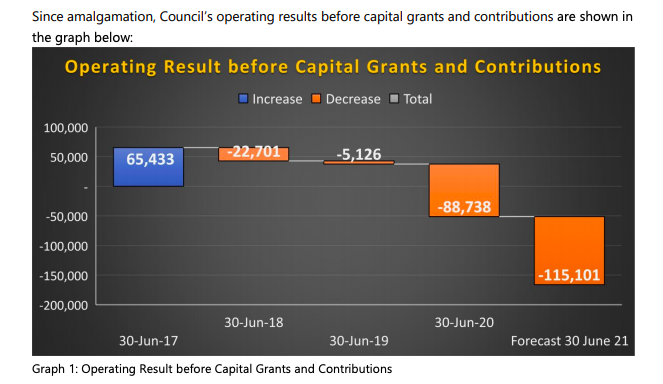

On Wednesday Mr Person delivered his interim report which tracks how Australia’s sixth largest Council went from a $65.4 million surplus at the time of its amalgamation in 2016 to a position where it needed a $6 million tax-payer bailout so it could pay staff.

This is a story about the failure of a council to understand or practise the basics of sound financial management.

Dick Persson

The report reveals that since 2016 accumulated losses have reached $232 million and debt has gone from $317 million to $565 million.

“The financial crisis confronting the Central Coast Council is very serious,” Mr Persson said, adding that poor financial decisions and “catastrophic budget mismanagement” had led Council to its current parlous state.

“This is a story about the failure of a council to understand or practise the basics of sound financial management.”

Unlawful use of restricted reserves

The report makes no findings of theft or corruption.

However, it says the newly amalgamated council “clearly did not understand how much money they had at the outset” and embarked on a reckless program of capital works and services that was well beyond its means.

Much of the new expenditure was funded from restricted reserves, which Mr Persson said was either unlawful or done without the approval of the elected body.

He says the previous CFO, Craig Norman, and the former CEO Gary Murphy were aware of the unlawful use of restricted reserves.

“While the exact time they became aware remains hard to ascertain, emails and notes indicate they continued to spend funds unlawfully after they became aware and before they advised the elected body,” he says.

Bitter medicine

Mr Persson has outlined a series of measures to get Council back on track including at least $40 million worth of asset sales, a “major reduction” in senior and middle management, and an increase in some council charges.

The report recommends returning staff levels, currently at 2,117, to amalgamation levels of 1,875, which would amount to a reduction of more than 240 jobs.

Mr Persson said Council’s financial disaster was not directly related to amalgamation, a factor which council has pointed to in the past, although he acknowledged it was a contributing factor.

“Managing the Council’s financial position is the number one job of the CEO and CFO,” Mr Persson said.

“It is clear the CEO was either unaware of the looming crisis, or simply failed to adequately respond. Either way the performance of the CEO was unsatisfactory.

“Council, in their role as the governing Body, also shares that financial responsibility. They also failed in this regard.”

Mr Persson announced on Monday that Mr Murphy, who has been on recreational leave, had been axed “effective immediately” and the recruitment of a new CEO would start soon.

He has also requested a three-month extension of the administration period, which was set to conclude next February.

How much of this catastrophic result can be sheeted back the the forced council amalgamations of the government members at the time.

I am glad my local council fought the amalgamation successfully.

Unfortunately Clif the amalgamation of Gosford and Wyong councils was voluntarily agreed upon.

As one of Australia’s longest serving Community and Economic Development Practitioners (full time with 4 different Councils and contracting to other organizations) I have followed the amalgamation debate since it began – right back at the “Beattie” era.

In 2014 I published the linked article and updated in 2020 and again today (Feb 2021) It asks the question of forced mergers “Amalgamation or Abomination – which?” based on bringing in a broader perspective that addresses the social impacts . Please take time to consider this perspective. https://issuu.com/bobneville9/docs/theaword

This story is becoming more and more familiar with a lot of councils. I fear that our Council is well down the same road. There seems to be a total disconnect with the community, a total lack of transparency in everything they do and I personally have no faith in the current councillors ability or resolve to determine our future.

Council management are driving the bus and the Councillors are just passengers.

I have grave fears for our future if this council continues to go unchecked in all facets of management.

Sadly, Chris, it is a similar story in Qld. (One) Council continues to introduce yet more secrecy and buck the State Govt’s recent legislative changes aimed at increasing transparency. The CEO has the say on what info councillors can and can’t be provided with following a request (in writing to the CEO now!). Councillors are now effectively gagged, however this actually suits most of them as they now have a excuse for not engaging with their constituents. Those whose entire contribution to a lengthy council meeting consists of ‘I second the motion’ have no qualms re putting their hands out for their pay cheques. What’s that? Go to the Independent Assessor? What a joke!

You must be in North Qld with those comments.

Quite appalling to observe a CEO completely hoodwink his board over and over… these habitual destroyer of careers & organisations leave a trail of destruction whilst self-promoting themselves to whoever will listen whilst setting up their next move!

No, not Nth Qld – SE Qld. If you have a CEO whose annual performance review is conducted by a dictatorial mayor and only ONE Cr out of 6 who speaks up, what can you expect.

Your council sounds very much like mine, Chris. It was formed by the amalgamation of councils in 2016.

The merged council was given state government funding in 2016, $10 million as part of the New Council Implementation Fund and another $10 million as part of Round One of the Stronger Communities Fund program. It was given another $9.5 million in 2018 as part of the dodgy Round Two of the NSW Government’s Stronger Communities Fund. Reporting to Council and the public on the progress of these grants has been absolutely woeful – irregular, inconsistent, figures not making sense etc. Funds to be spent on a system to treat stormwater to irrigate playing fields (the only bit of environmental infrastructure in all the projects identified for funding) were instead used to build five cricket pitches. Funds to be spent on one synthetic playing field and sports amenities building at another park were used to also build an extra synthetic playing field, and a netball court and amenities building. Project after project, using these funds and ratepayers’ money have run over budget. Responses from the General Manager and other council officers, the mayor, our local MP and even the Planning Department raise even more questions. And interestingly, but more disturbingly a project management governance audit planned for 2019/20 was deleted. Mismanagement, overspending and lack of transparency appears to business-as-usual.

Amalgamation is a distraction here. The fundamental issue of failure in financial management is what needs to be unpacked. Local government accounting is quite complex, and many Councillors don’t comprehend its mysteries. Why would they? They’re usually given no training in it, and yet as “directors” they have a governance duty. A CFO/CEO combination trying to muddy up financial realities could do so. The Council must have been approving unsustainable budgets, and receiving quarterly financial reports telling the story, but didn’t know how to interrogate the figures. A recipe for the disaster we know see. There are lessons to be learned from this that should be widely circulated and discussed. Basic training for Councillors in interpreting financial reports is surely a must? And always check cashflow of unrestricted cash, and look for pinch points.

You could be right, Stephen! The quarterly financial reporting to councillors (and the community) has also been woeful.

Quarterly Budget Review Statements do not follow the Office of Local Government’s guidelines. Some are in picture format so not capable of being searched or copied and pasted, in other words, not councillor or community friendly. Unrestricted cash figures not provided. One published QBRS not the same as that endorsed by the councillors…and this questionable QBRS was put inside a half yearly progress report and published on the wrong webpage. Contracts listed in one QBRS are exactly the same as those in the QBRS submitted to council six months previously. Names of contractors not always provided. Incorrectly labelled QBRS. QBRSs submitted to council late. Order of columns of figures changed from one QBRS to the next…

I don’t know if the councillors asked questions, but I have…and I am not happy with the answers!

When will State Government enshrine and limit the functions of council for essential services only.

Council’s don’t need (though they want) multiple sister city associations, when in fact these are often used as holiday junkets for senior management and councilors.

Mandatory and essential community services should limit the human stupidity and ignorant behaviour endured by the community through the late 1990 and 2000.

What we have learned from that period to present time is mismanaged is repackaged with new fancy brochures, whilst ineptitude continues at massive cost to Community and Tax Payers.