A survey of Victorian local government financial professionals has found that many councils are expecting to report their first ever operating deficits in the 2021 financial year as COVID-19 takes its toll.

Many have resorted to taking loans and dipping into cash reserves and 20 per cent have responded to community pressure by not increasing rates for 2020-21.

The decision to sit on rates will result in “significant long-term losses,” the report by the Local Government Information Unit warns.

The report released this month looked at how local counils in Victoria have responded to COVID-19 in their 2020-21 budgets, based on a survey by FinPro, the peak body for local government finance professionals representing the state’s 79 councils.

Councils are now faced with a new post-COVID-19 normal – one which previous history and experience offers little guidance on how to adapt in order to meet the new needs of their communities

“Many local governments surveyed are expecting to report operating deficits in the 2020-21 year (some for the first time) and a number of local governments (especially smaller rural entities) are faced with bleak long-term financial outlooks,” it says.

The report says the grim financial outlook has been driven by loss of revenue from closed services and facilities, and the cost of maintaining its full workforce without access to the Commonwealth’s JobKeeper package.

Other contributing factors are the cost of council support and stimulus packages, the devastating summer bushfires, compliance costs for the new Local Government Act and council elections to be held next month.

Rates and charges

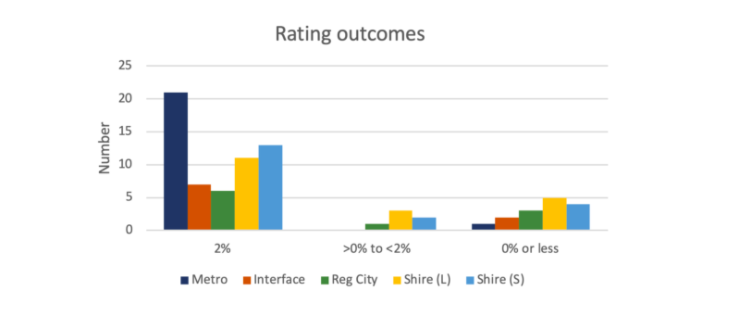

The survery found that 15 of Victoria’s 79 local governments did not increase rates.

One council, Ararat Rural City, offered a small rate reduction.

However metropolitan councils had average increases of 1.9 per cent and 95 per cent increased rates equal to the 2 per cent cap.

Regional cities had the smallest average rate increases of 1.4 per cent.

“For the 15 Victorian local governments that decided to adopt 0% rate increases, the long-term financial impacts of such a decision are significant,” the report says.

These include Melbourne City Council, which stands to lose $68 million in lost rates over the next ten years; Melton City ($28 million) and Latrobe Regional City ($18 million).

“While Victorian councils feel under pressure to offer up zero per cent rate increases (or even rate decreases) for the 2020-21 year … the long-term financial impacts of such decisions are significant given the compounding effect of changes in the rate base,” the report says.

Councils also provided a range of rebates, waivers, discounts and fee relief.

Most councils increased fees and charges in line CPI or market rate but eight kept their fees and charges at 2019-20 levels.

Support packages

Metropolitan councils put forward stimulus packages of between $13.5 million and $2.8 million, with City of Melbourne chipping in $50 million.

Even the smallest Shires offered between $1.7 million and $200,000.

Councils like City of Sydney and City of Melbourne also put forward comprehensive COVID recovery plans.

City of Sydney’s plan includes a $25 million infrastructure stimulus and $47.5 million in relief for small businesses and the arts sector.

City of Melbourne, which made recovery the focus of its entire budget, was one the most severely affected councils.

The budget reveals it took a $101 million hit from covid resulting in an underlying deficit of $57.4 million – the city’s first deficit in 30 years.

“Councils are now faced with a new post-COVID-19 normal – one which previous history and experience offers little guidance on how to adapt in order to meet the new needs of their communities,” the report says.

“A great deal of planning will be required by the sector to respond to the aftermath of the pandemic.”

For most people in the Govt/Local Govt arena this would be not totally unexpected.As we work our way through 2020-2021-2022 I fear the true picture of the situation will evolve.Unless State and Federal Govts chip in to assist the situation, the programs of Council set out in there Council/Business plans will be reduced to the bare minimum.Remember this is the biggest hit in 100 years to everybody worldwide and I truly hope the damage to service provision over the medium term is not substantial

And its an interesting environment to be re-negotiating an Enterprise Agreement. Regardless of the pattern of increase over the past two or three years, this is an entirely new and unknown future. It could be that the best action from a strategic perspective is to delay finalising an agreement until more information is available about CPI movement and unemployment levels post JobKeeper and boosted JobSeeker (particularly in Victoria).