Sunshine and rainbows for GMs of merged councils?

By Egan Associates

As NSW Councils prepare for impending mergers, general management have been requested to apply for jobs in the merged entities with the knowledge that there will be fewer roles on offer.

Amalgamating Councils will either be able to save money by hiring fewer senior staff to fill the new general management positions at the same remuneration level or endeavour to improve the quality of management by increasing the amount of remuneration available for the merged entities’ top positions.

In order to consider how much the mergers will provide for these options, Egan Associates collected data on the remuneration of the general manager and senior staff at 44 metropolitan and regional/rural councils, some which are due to merge under the NSW government’s local government plan and some which are due to remain as standalone entities.

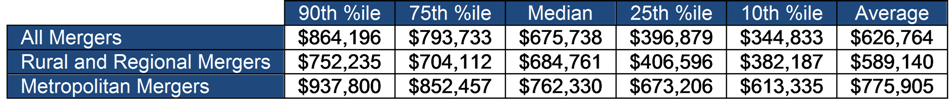

For the Councils examined, the most recent remuneration for a general manager pre-merger was:

Does the remuneration match the commercial market?

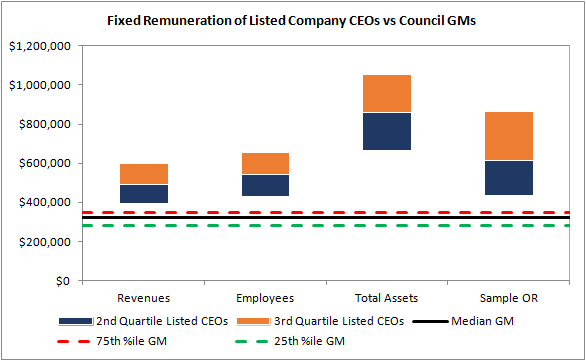

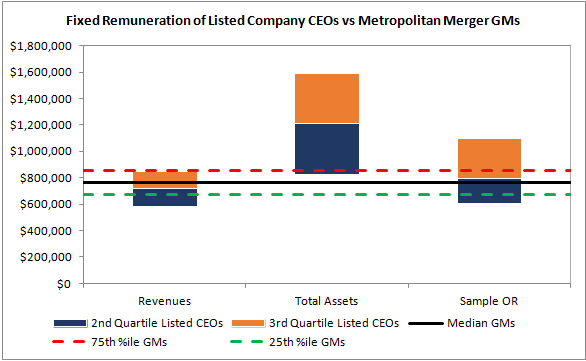

To provide perspective on the relative competitiveness of Council general manager remuneration, Egan Associates extracted data on CEOs of listed companies with similar revenues, assets or employee numbers (or any one of these metrics).

The graph below shows the range of fixed remuneration from the 25th to the 75th percentile for listed company CEOs with similar metrics to the councils, with the break in the range denoting the median.

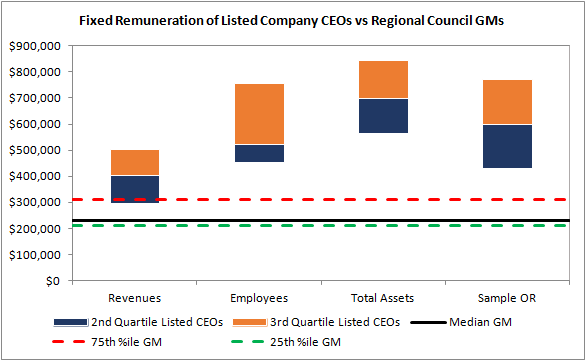

The same graph for rural or regional councils is below.

The same graph for metropolitan councils is below.

As shown, the payment of Council general managers is modest by comparison to that of listed CEOs managing enterprises with comparable metrics on behalf of shareholders not resident stakeholders.

Notwithstanding the above observations we should state that managing a public company with equivalent revenue and expenditure is a very different task. From a work value perspective their role is very different.

Councils have a monopoly on revenue entitlement, limited flexibility with respect to expenses and constraints on staffing levels and costs. The governance of local councils is also very different and the skill sets of members at variance from a public company as their prime purpose is to serve as the residents’ representative.

Core objectives for councils include managing assets and appropriately deploying available revenues, primarily managing tasks which will be influenced by the quality and state of assets and their maintenance as well as emerging requirements arising from population growth and the demand for different housing formats.

The General Manager, or Principal Executive of the Council, while desirably having a core objective of building surpluses to cope with unexpected expenditure, is not driven by a profit motive but rather a community service motive, albeit within complex commercial constraints.

The customer base of a local government organisation is the entire community, which is generally not the case in relation to a listed public company where their key customer stakeholders are more narrowly defined in the majority of instances. The priorities within a listed public company environment are usually determined by an annual plan and a 3-year strategic plan or outlook and only vary when market circumstances dictate or opportunities arise. In the case of local government their priorities can be changed by constituent demands, unexpected events, or priorities that are varied by members of Council in meeting constituent demands.

Reward within councils is largely governed by a Local Government Remuneration Tribunal which is appropriately influenced by pay settings adopted in the public sector generally and across other Councils, be they metropolitan or regional. These influences establish an entirely different dynamic to that in listed companies and offer limited flexibility to Mayors in seeking management talent to meet the core objectives.

How much money would be available for savings or additional remuneration after the mergers?

Egan Associates considered ten mergers in metropolitan areas and five in regional/rural areas. The amount that would be available for remunerating the general manager if costs remained the same would be:

If savings are the goal, mergers would create between $100,000 and $500,000 in savings for merged councils focussing solely on the position of general manager.

If the utilisation of the sum or say 75% of the combined cost is the goal to attract new blood or retain the best and brightest in local government, this amount can be added to prior budgets.

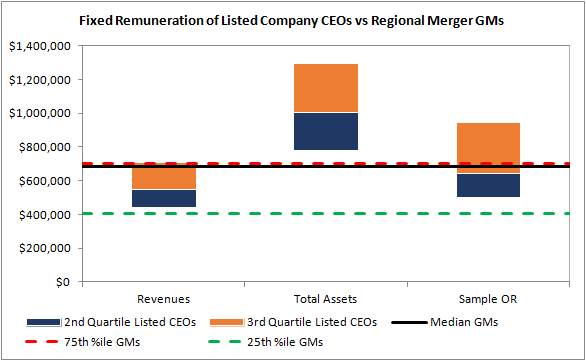

Comparing the new potential General Manager remuneration to the remuneration to CEOs of listed companies with similar revenues and total assets adjusted to reflect the merged entities (not employees as the number of employees at the councils will reduce following synergies) the graphs are as follows:

It is apparent that the mergers would allow councils to offer a more competitive reward for the position of a general manager. The opportunity reflected above is likely to spread to improving the leadership team and their support across all merged councils while also reducing cost and improving efficiencies.

In our view, merging councils must ensure that the new senior management roles are clearly documented and the work value differential compared to prior leadership roles determined before recruitment and pay decisions are made.

Amalgamations will lead to increased work value at the level of general manager and the majority of a general manager’s direct reports.

In work value terms, while knowledge and experience to run a current council will not be dramatically uplifted in oversighting a merged entity, the diversity of the role will marginally increase as well the breadth of activities. The leadership demands will also increase with larger workforces. The organisation will be more complex and judgement a touch more demanding. The requirement for innovation should be high on the agenda.

In this context, while not a dramatic change in work value, the uplift will be primarily by scale, the demand for innovation and heightened risk management.

Rather than offering a dramatic increase in fixed remuneration, a key opportunity for the merged entity Councillors would be to create an incentive program with appropriate performance criteria such that additional reward would arise from success in areas which make a difference to the community, the Council’s financial viability and prosperity, its investment decisions and its capacity to borrow as required while also elevating the level of engagement of staff and their engagement with the constituents.

The opportunity poses an interesting conundrum for councils that are remaining standalone. For example the City of Sydney, which currently pays its general manager around $450,000. Its resident population sits at the median of the merging councils that Egan Associates examined, while its revenues and its total assets are at the top of the range. If other Councils decide not to bank the potential savings arising from redundant leadership positions but rather reinvest the current wage cost in hiring and/or retaining higher quality candidates, will Councils such as the City of Sydney need to follow suit and will they be in the position to do so?

The link to this story is here.

Leave a Reply