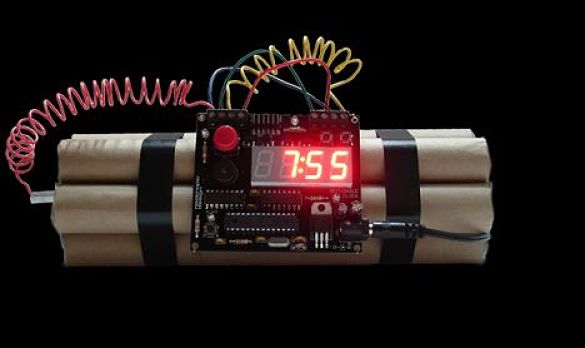

A four-year freeze on rates for newly merged NSW councils is a ticking time bomb, says the state’s local government peak body.

Independent Pricing and Regulatory Tribunal (IPART) held a public forum today (Tuesday) to thrash out possible changes to how rates are calculated, including examining how NSW Premier Mike Baird can impose the extended freeze on amalgamating councils’ rates and whether councils should be able to apply for a special rate rise during this time.

Read more about the inquiry here.

Mr Baird has said he wants merging councils to stick to a rating trajectory as if they had not merged and he is under pressure to keep his promise that rates will not rise – and may even fall – under new mega councils.

Shaun McBride, Senior Strategy Manager at Local Government NSW (LGNSW), called it “bad policy” and said: “Apart from freezing [rates], you almost set a time bomb for the end of year four”, when he said ratepayers could be hit with sudden rate hikes.

“This policy is going to mean harmonisation doesn’t really commence until year four, when I think you should be completing the rate structure harmonisation by the end of year four,” he said. “We can foresee all types of problems with this.”

Mr McBride said the rates freeze conflicted with the stated main aim of the Fit for the Future program, which was to make councils financially stable.

“It will create and perpetuate division in the community between councils with higher or lower rate structures and prolong the process.

“At the end of the four-year period councils might go for a one-off increase in special rate variations and the difference between high rating [councils] and low rating has probably grown in that period.”

LGNSW President Keith Rhoades said the terms of reference for the inquiry directed IPART to recommend the best way to freeze rate paths for four years.

“It’s understandable that the State Government wants to be seen as the good guys in this exercise – but the reality is that a four-year rate path freeze for amalgamating councils will only exacerbate the very real problems the review is supposed to help fix,” Mr Rhoades said. “We’re undermining the chance of a comprehensive solution before we start.”

“It’s easy to label councils greedy or lazy in a three-second sound-bite, but that sort of superficial approach achieves nothing,” he said.

“It certainly doesn’t deliver the outcome we all want, which is a financially sustainable local government system able to deliver the right level of services to residents and ratepayers.”

Rates are one of the many complicated issues that merging councils need to address. There may be large differences in rates and service levels between merging councils, as well as differences in fees and charges, such as parking fines.

The aim is to equalise these elements over the years under the new, larger councils but it is up for debate how gradually this should be done and when the transition should begin.

LGNSW has argued the last three decades of ratepegging, combined with freezing the indexation of Financial Assistance Grants and higher levels of cost-shifting from state and federal government onto local councils has caused a hefty infrastructure backlog and misery for local councils.

The organisation backs a proposal allowing merging councils to apply for special rate variations under a broad range of circumstances, including to finance new infrastructure or to renew existing infrastructure.

Other subjects for discussion during the IPART review include changing the method used to calculate rates. One suggestion is to base them on the Capital Improved Value (CIV) of land – more easily understood by the public as the market value – rather than the Unimproved Land Value.

NSW Valuer General Simon Gilkes said that developing a database capable of capturing this information – would cost “tens of millions”, although this could obviously be balanced by any increases in revenue if the system was introduced.

Victoria, which bases its rates on the CIV, has had a database capturing property improvements since the 1960s.

“We need to capture a lot of data to move to a new capital improvement value system. It’s complex and expensive,” Mr Gilkes said.

It is a switch that many local councils support, particularly those in high density areas, as it would push apartment owners to pay higher rates, although it could also discourage people from doing renovations.

There was also heated debate over whether the raft of organisations entitled to rate exemptions should change, this includes schools, hospitals, churches and charities.

Local government is also pushing the state to fully fund rate rebates given to pensioners, which is currently a 50:50 deal in NSW but fully funded in other states, such as South Australia and WA.

The General Manager of Tumut Shire Council, Bob Stewart, said 62 per cent of his council’s area was unrateable as it contained thousands of kilometres of state forest, national parks and dams. Mr Stewart said that some commercial companies were exempt from rates, despite turning a profit and using council-provided services.

Mr McBride said some rating exemptions were a hangover from the late 1800s and they were overdue for a rethink. LGNSW backs partials or scaled exemptions or rate rebates to “better target exemptions” instead of the current system.

Submissions to the IPART rates review close on May 13 and an interim report expected to land on NSW Local Government Minister Paul Toole’s desk in June. The final report is expected in December 2016.

Why do we need to increase rates every year anyway. Surely the new developments, subdivisions and newly created lots provide a natural rate-take increase that should suffice for the council.

Why do Councils insist on continuing on the most inefficient employment systems of unionised and lazy unsociable employees where contractors could provide better services much cheaper.

Why do councils need to be so bloated with office staff.?

We don’t need rate rises, we need councils to be far more accountable to how they spend rate money, and to keep tabs on the levels of staff they retain. Councils need to be run far more efficiently, not like empires of bureaucracy that they are nearly all now.

I have been told by a senior council executive, when I questioned why they would employ all the drones from the footy club in the local town as ‘outdoor staff’ that if council didn’t employ them nobody else would.

Councils are not to be run as charities.

What a joke. Only the LGNSW would think that a rate freeze is a bad idea. I wonder what ratepayers think about this policy idea? The point of having “mega councils” is that they shouldn’t need to raise rates to ridiculous levels.

On the contrary, local government in Australia is one of the lowest funded in the world. There is little waste and lots of challenges to keeping rates low. A four year freeze is not realistic.