An audit has found the ATO’s management of GST fraud control needs to improve, following an investigation into widespread GST fraud which included 150 tax officials.

Some of the officials currently face criminal investigations, the Australian National Audit Office (ANAO) says.

A report released by the national audit office this week says a lack of clarity about roles and responsibilities, inadequate implementation of assurance requirements and the absence of an overall view of the risk environment is undermining the government’s efforts to minimise money being lost to GST Fraud.

And while the tax office has in place ‘partly effective’ strategies to prevent fraud, “the framework for assessing and managing GST fraud risk is not fit for purpose”.

The ATO also lacks a strategy to deal with large-scale fraud events, the report concludes.

Operation Protego

The audit came after the ATO became aware of a significant increase in attempted GST scams between 2021-22, linked to the promotion of GST fraud on social media channels.

The discovery led to the announcement in May 2022 of Operation Protego, which has resulted in more than 100 arrests, 16 convictions, $120 million in penalties and a number of people being jailed.

The ANAO says Operation Protego targets are suspected of scamming up to $2.4 million in fraudulent GST refunds.

The ATO estimates more than 57,000 people were involved in the fraud, including ATO officials.

The ATO confirmed with the ANAO that, as of October 2023, 150 ATO officials suspected of Operation Protego behaviours have been investigated using the ATO’s standard internal fraud procedures.

ANAO

“The ATO confirmed with the ANAO that, as of October 2023, 150 ATO officials suspected of Operation Protego behaviours have been investigated using the ATO’s standard internal fraud procedures,” Auditor General Grant Hehir says in the report.

“A range of treatment strategies have been applied by the ATO, including termination of employment and criminal investigations.”

The total primary liabilities raised since Operation Protego began in mid-April 2022 to 30 June 2023 is $2 billion, with $2.7 billion in suspect GST refunds stopped before payment.

Operation Protego was closed to new cases on November 3, 2023.

ATO accepts recommendations

The ATO has agreed to all five recommendations made in the report to improve responses to fraud and boost assurance.

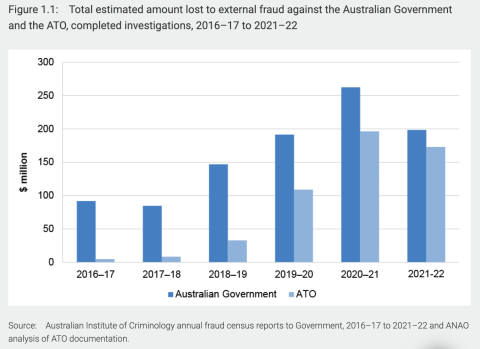

The ATO lost an estimated $173 million to external fraud in 2021-22, a massive increase from $4.7 million in 2016-17.

The number of GST-related fraud tip-offs to the ATO has also increased from 125 in 2019-20 to 2,170 in 2022-23, with a total of 4,745 tip-offs in the last four years.

The ATO collected $81.4 billion in GST in 2022-23, up from $48.4 billion in 2012-13.

Leave a Reply